Choosing the right payment gateway for your WooCommerce / Shopify dropshipping store in 2026 is no longer just about transaction fees.

It’s about risk, payout stability, chargebacks, and whether your money stays accessible while you scale.

Many dropshipping stores fail not because they can’t sell — but because their payment gateway freezes funds, applies rolling reserves, or shuts them down entirely.

This guide breaks down the best payment gateways for WooCommerce dropshipping in 2026, based on real-world usage, risk tolerance, and long-term scalability.

What Matters Most in a Payment Gateway (2026)

Before comparing providers, you need to understand what actually matters today:

- Predictable payouts (no sudden freezes)

- Fair chargeback and dispute handling

- WooCommerce compatibility

- Support for international customers

- Low tolerance for “high-risk” flags

- Transparent reserve policies

The cheapest gateway is useless if you can’t access your money.

1. Stripe – Best Overall Payment Gateway

Stripe remains the best all-around payment gateway for WooCommerce dropshipping in 2026.

It’s developer-friendly, scales well, and — most importantly — behaves predictably when your business is set up correctly.

Stripe Pros

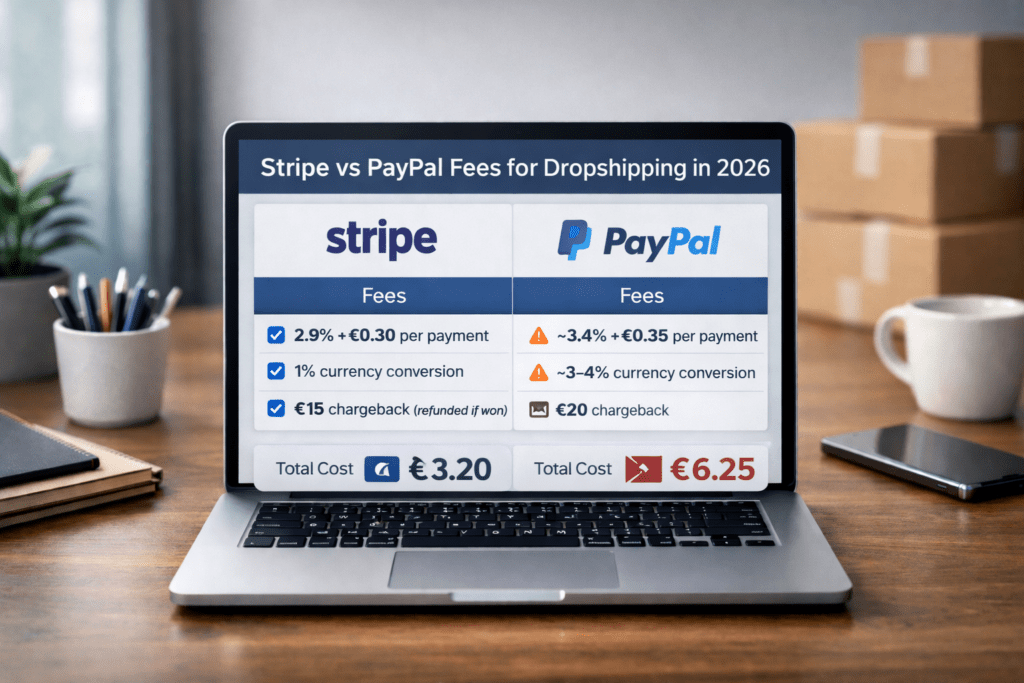

- Fees: 2.9% + €0.30

- Clean WooCommerce integration

- Refundable chargeback fees (if you win)

- Supports subscriptions, wallets, and cards

- Strong API and automation support

Stripe Cons

- Sensitive to poor fulfillment practices

- Can apply rolling reserves if risk increases

- Requires clean business setup and transparency

Best for: Branded stores, private-label dropshipping, long-term scaling.

2. PayPal – Best for Trust, Worst for Control

PayPal is still valuable — but it should never be your only gateway.

Customers trust PayPal, which can increase conversion rates. However, PayPal is extremely buyer-friendly and aggressive with account limitations.

PayPal Pros

- High customer trust

- Familiar checkout experience

- Easy setup

PayPal Cons

- Higher fees: ~3.4% + €0.35

- Currency conversion margin (3–4%)

- Frequent balance freezes

- Chargeback fees are non-refundable

Best for: Secondary payment option, not primary processor.

3. Mollie – Best for EU Dropshipping

Mollie is one of the strongest payment gateways for EU-based WooCommerce stores.

It supports local European payment methods and has transparent pricing with less aggressive freezes compared to PayPal.

Mollie Pros

- Supports SEPA, iDEAL, Bancontact, Klarna

- Transparent pricing

- Good WooCommerce plugin

- EU-friendly compliance

Mollie Cons

- Limited outside Europe

- Not ideal for US-heavy traffic

Best for: EU-focused WooCommerce dropshipping stores.

4. Square – Solid but Region-Limited

Square works well in supported regions and offers predictable pricing, but its availability is limited compared to Stripe.

Square Pros

- Simple pricing

- Stable payouts

- Good WooCommerce integration

Square Cons

- Limited country availability

- Less flexible for complex setups

Best for: Smaller stores in supported countries.

5. Local Bank Gateways – Low Risk, Low Flexibility

Some WooCommerce stores rely on local bank gateways or regional processors. These are often safer from freezes, but:

- Have lower conversion rates

- Offer fewer international payment options

- Lack modern features

Best for: Hybrid setups or backup payment options.

Gateways You Should Avoid for Dropshipping

Be cautious with:

- Unknown offshore processors

- “High-risk specialists” promising guaranteed approval

- Gateways with unclear reserve policies

If a processor sounds too easy, it usually comes with hidden risk.

The Best Payment Gateway Setup (2026)

The safest and most effective setup today:

- Primary: Stripe

- Secondary: PayPal

- Optional (EU): Mollie

- Backup: Local bank gateway or COD (if applicable)

This setup balances conversion rate, risk management, and cash flow stability.

Why Payment Gateways Freeze Accounts

Most freezes happen because of:

- Long shipping times

- High refund rates

- Poor customer communication

- No clear refund or shipping policy

- Selling restricted products

The gateway is rarely the real problem — the business setup is.

Final Verdict

There is no “perfect” payment gateway — only the right setup.

- Stripe is best for serious scaling

- PayPal increases trust but adds risk

- Mollie is excellent for EU stores

- Backup options protect cash flow

If you want to scale dropshipping in 2026, your payment gateway strategy must be intentional, not accidental.

At Money Drip, payment safety is built into supplier selection, fulfillment speed, store structure, and risk-aware scaling —

because growth means nothing if your money is frozen.